Us Supply and Utilization Table for Beef

By Brian Deese, Sameera Fazili, and Bharat Ramamurti

The President understands that families have been facing higher prices at the grocery store recently. Half of those recent increases are from meat prices—specifically, beef, pork, and poultry. While factors like increased consumer demand have played a role, the price increases are also driven by a lack of competition at a key bottleneck point in the meat supply chain: meat-processing. Just four large conglomerates control the majority of the market for each of these three products, and the data show that these companies have been raising prices while generating record profits during the pandemic. That's why the Biden-Harris Administration is taking bold action to enforce the antitrust laws, boost competition in meat-processing, and push back on pandemic profiteering that is hurting consumers, farmers, and ranchers across the country.

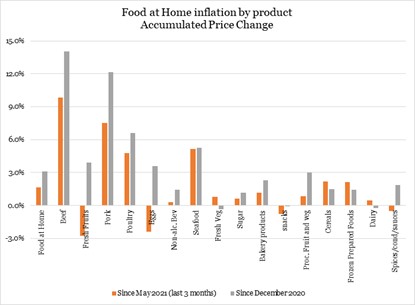

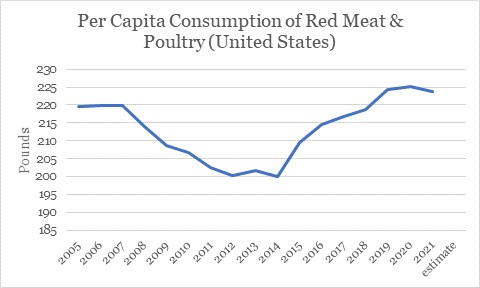

Meat constitutes half of food at home price increases. Large price increases for beef, pork, and poultry are driving the recent price increases consumers are seeing at the grocery store (a measure commonly known as "food at home"). Together, these three items account for a full half of the price increase for food at home since December 2020. Since that time, prices for beef have risen by 14.0%, pork by 12.1%, and poultry by 6.6%.

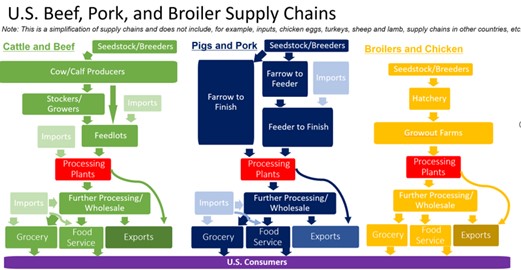

Four large conglomerates overwhelmingly control meat supply chains, driving down earnings for farmers while driving up prices for consumers. The meatpacking industry buys cattle, hogs, and chickens from farmers and ranchers, processes it, and then sells beef, pork, and poultry on to retailers like grocery stores. The industry is highly consolidated, and serves as a key choke point in the supply chain (see figure below).

Today, just four firms control approximately 55-85% of the market for these three products, according to U.S. Department of Agriculture data. That reflects dramatic consolidation of the industry over the last five decades, as the large conglomerates have absorbed more and more smaller processors. In 1977, the largest four beef-packing firms controlled just 25% of the market, compared to 82% today. In poultry, the top four processing firms controlled 35% of the market in 1986, compared to 54% today. And in pork, the top four hog-processing firms controlled 33% of the market in 1976, compared to 66% today.

That consolidation gives these middlemen the power to squeeze both consumers and farmers and ranchers. There's a long history of these giant meat processors making more and more, while families pay more at the grocery store and farmers and ranchers earn less for their products. Absent this corporate consolidation, prices would be lower for consumers and fairer for farmers and ranchers.

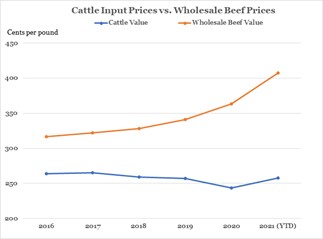

The meat-processors are generating record profits during the pandemic, at the expense of consumers, farmers, and ranchers. The dynamic of a hyper-consolidated pinch point in the supply chain raises real questions about pandemic profiteering. During the pandemic, wholesale prices for beef rose much faster than input prices for cattle. That means that the prices the processors pay to ranchers aren't increasing, but the prices collected by processors from retailers are going up.

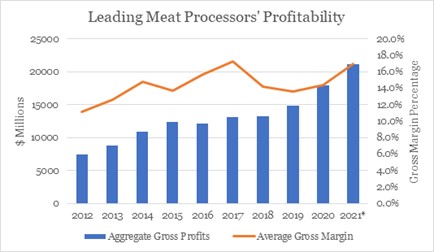

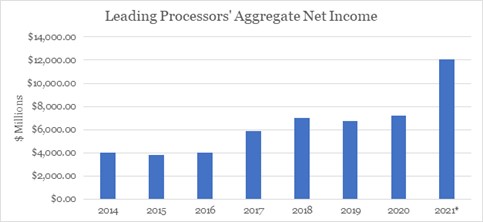

At the same time, we have seen some of the top firms in this industry generate record gross profits and their highest gross margins in years. Gross profits for some of the leading beef, poultry, and pork processors are at their highest levels in history, and Q1 2021 and Q2 2021 were the most profitable quarters in history for some of these processors. Net income for many of these companies is on pace to reach historic highs as well. (Other top processors simply don't report publicly on their profits, margins, or income.)

*2021 numbers are projected using the quarterly numbers reported this year.

These record profits, income, and margins underscore the role that meat-processors' dominant market position and power play in increasing meat prices. While factors like consumer demand and input costs are affecting the market, it is the lack of competition that enables meat processors to hike prices for meat while increasing their own profitability. That is, if they faced meaningful competition, the processors would simply be able to extract fewer profits if their costs had gone up unexpectedly while keeping prices lower to earn retailers' business.

Some of these companies have also been rewarding their shareholders with large dividends and buybacks during this period. For instance, the large processor JBS provided $2.3 billion in dividends and share buybacks in 2020. It has proposed record high dividend payments for 2021, increasing payouts to shareholders by nearly 75% over 2020. Similarly, Tyson recently raised dividends by 6% for fiscal year 2021, spending $477 million on dividends in the nine months ending July 2021. It also repurchased $200 million of shares between September 2020 and July 2021.

These record profits and dividend payments come at a time when consumers are paying more to put food on the table, workers are risking their health and safety to keep America fed, and farmers and ranchers are also facing unprecedented droughts, wildfires, and other extreme weather events that put their herds and farms at risk. Meanwhile, taxpayers have made historic investments to help businesses keep their doors open and families cope with the economic impacts of this pandemic. These taxpayer investments have kept per capita demand for meat steady, unlike the collapse in demand the meat industry experienced in the Great Recession.

As we restart the world's largest economy and make great strides in the economic recovery, the Biden-Harris Administration is committed to restarting right for the American people—consumers and producers alike—by transforming the food system. This is a pivotal moment of opportunity to build back a better food system that is fair, competitive, distributed, and resilient.

The Biden-Harris Administration and USDA are taking on these issues by:

- Taking strong actions to crack down on illegal price fixing, enforce antitrust laws, and bring more transparency to the meat-processing industry. USDA is conducting an ongoing joint investigation with the Department of Justice into price-fixing in the chicken-processing industry, which has already yielded a $107 million guilty plea by Pilgrim's Pride and numerous other indictments. USDA has also announced a more robust Packers and Stockyards Act enforcement policy and new efforts to strengthen Packers and Stockyards Act rules, so that meat-processors can't use their market dominance to abuse farmers and ranchers. And USDA is creating more transparency, with new market reports on what beef-processors pay, as well as new rules designed to ensure consumers get what they pay for when meat is labeled "Product of USA."

- Providing relief to small businesses and workers hurt by COVID, and creating a more competitive food supply chain. USDA will invest $1.4 billion in pandemic assistance to provide relief to small producers, processors, distributors, farmers markets, seafood processors, and food and farm workers impacted by COVID-19. This includes $700 million to reach small operations who have not received previous rounds of federal pandemic aid. USDA will also provide $700 million to states, tribes, and nonprofit organizations to distribute up to $600 per worker in relief payments directly to frontline farmworkers and meatpacking workers who incurred expenses preparing for, preventing exposure to, and responding to the COVID-19 pandemic. USDA will also invest $500 million in American Rescue Plan Act funds to support new competitive entrants to expand local and regional meat and poultry processing capacity. USDA will provide grants, loans, and technical assistance to create new meat and poultry processing capacity that will compete with the big guys, forcing them to lower prices and actually earn their business, and provide farmers and ranchers access to better choices and fairer prices in local and regional food systems.

- Getting ahead of climate change related disruptions by supporting farmers and ranchers from the effects of extreme weather. Unprecedented drought and extreme weather events have brought new challenges for farmers, ranchers, and agricultural workers, on top of the historic challenges associated with the COVID-19 pandemic. To respond to the drought affecting farmers and ranchers across the West and Midwest, USDA will expand its Emergency Assistance for Livestock, Honeybees and Farm-Raised Fish Program (ELAP) to include the cost of transporting feed, delivering much-needed relief to affected livestock producers.

- Working with Congress to make cattle markets more transparent and fairer. Right now, meatpackers have outsized power in setting the prices for beef, which are often set in opaque contracts that lock independent livestock producers into prices that aren't the product of free and fair negotiation. The Administration is encouraged to see bipartisan legislation by Senators Tester, Fischer, Grassley, Wyden, and others that seek to improve price discovery in the cattle markets—and facilitate actual negotiation of prices between livestock producers and packers. We look forward to working with Congress on these important issues, and we hope that they will also look for ways to ensure farmers and ranchers have fair access to meat-processing capacity.

All together, these actions will help build a food system that works for the American people above all else. They will support families, farmers, and workers while preventing bad actors in the supply chain from lining their pockets and getting further ahead without accountability. This will make the food system fairer and more equitable, more competitive and transparent, and more distributed and resilient against shocks. In turn, it will increase farmers' and ranchers' earnings, deliver greater value to workers, and offer consumers affordable, healthy food produced closer to home.

Source: https://www.whitehouse.gov/briefing-room/blog/2021/09/08/addressing-concentration-in-the-meat-processing-industry-to-lower-food-prices-for-american-families/

0 Response to "Us Supply and Utilization Table for Beef"

Post a Comment